Salt 2 Cap SKY newtype shop

It is with shattered hearts and gentle tears that the Fortin, McInnis and MacQuarrie families announce the sudden passing on January 2, 2024 of their sweet angel, Robin Rokelle Fortin, 56, of New Waterford. Born November 16, 1967 in Glace Bay she was the beloved daughter of Mildred MacQuarrie and the late Harvey McInnis.

halo commodity ハロコモディティ Salt 2 Cap Rimba

A compromise option that would make permanent a more generous version of the cap compared to current law by increasing the amount to $15,000 single ($30,000 joint) would raise $564 billion over 10 years after losing revenue under the current law baseline in 2024 and 2025. A full SALT deduction would cost about $226 billion in 2024 and 2025.

BAAS arquitectura, Pedro Pegenaute · CAP Salt 2 · Divisare

Jordi Badia of Barcelona practice BAAS Architects has completed the CAP Salt 2 health centre in the town of Salt near Girona, Spain. The exterior of the building is clad in galvanised sheet metal.

Un nou col·lector al CAP Salt 2 posarà fi a les inundacions Salt

Dec. 2, 2022, at 9:34 a.m. The SALT deduction can include real estate taxes and either sales taxes or income taxes you've paid during the year to state and local governments. (Getty Images).

1974 SaltII treaty signed limiting nuclear arms. Why could Gerald Ford do what Trump is

Age 53, Truro, passed December 31, 2023. Memorial and donation fundraiser to be held from 2-7 p.m., Sunday, January 28, at Truro Horsemen's Club, 288 Main St., Bible Hill. Full obituary and condolences at: www.mattatallvarnerfh.com Recent Stories.

The Cold War 5 things you might not know CNN

El CAP Alfons Moré y Paretas (Salt 2) se encuentra en Paseo del Marquès de Camps, 52, 17190, Salt, en el siguiente mapa podrás ver el punto exacto, para que sepas como llegar: Para llegar a este centre d'atenció primaria, puedes hacerlo mediante transporte público: Autobús Líneas L3, L4 y L9 Carretera GI-535.

SALT caps Victory Weider Proteka

The state and local tax (SALT) deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. The Tax Cuts and Jobs Act (TCJA) capped it at $10,000 per year, consisting of property taxes plus state income or sales taxes, but not both. How Does the SALT Deduction Work?

CAP Salt 2 / Jordi Badia ArchDaily México

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act, a tax reform passed in 2017. The deduction was unlimited before 2018. How to claim the SALT deduction on your 2022 taxes. You can only claim the state and local tax deduction if you itemize deductions on your tax return. That means you do not take the standard.

BAAS arquitectura, Pedro Pegenaute · CAP Salt 2 · Divisare

CAP Salt 2 / BAAS Share Public Architecture • Salt, Spain Architects: BAAS Arquitectura: BAAS Year: 2004 Text description provided by the architects. The project guarantees functional and.

Opiniones de salt ii

But you must itemize in order to deduct state and local taxes on your federal income tax return. Second, the 2017 law capped the SALT deduction at $10,000 ($5,000 if you're married and file.

Salt Caps Victory Endurance 90 cap. Invictus

23 likes, 0 comments - capecodderresort on January 5, 2024: "Embark on a cinematic winter journey! Head to the NS Winter Film Festival, just a scenic 32-minut."

Un nou col·lector al CAP Salt 2 posarà fi a les inundacions Salt

This would reduce federal revenue by about $135 billion between 2022 and 2025. Conventional Revenue Effect of Options to Relax the State and Local Tax (SALT) Deduction. All three options would primarily benefit higher-earning tax filers, with repeal of the SALT cap increasing the after-tax income of the top 1 percent by about 2.8 percent; the.

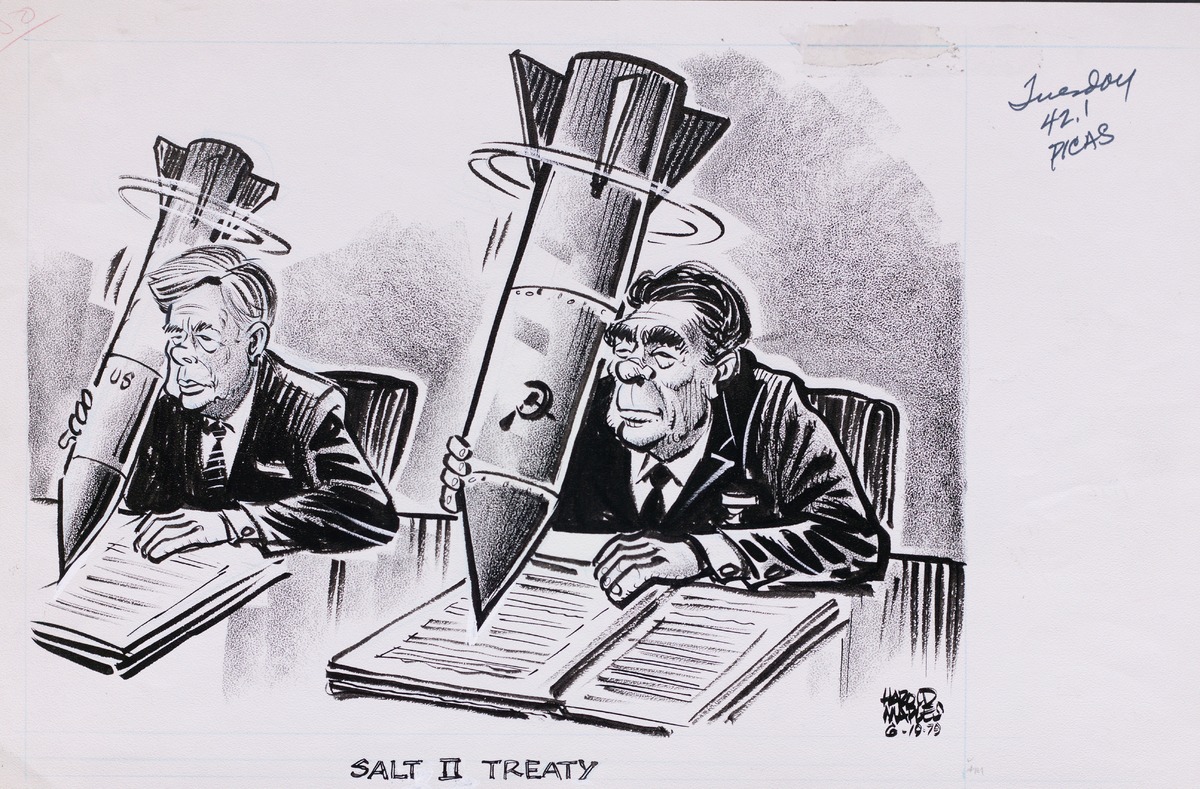

Signature des accords SALT II (Vienne, 18 juin 1979) CVCE Website

Image 1 of 11 from gallery of CAP Salt 2 / BAAS. CAP Salt 2 / BAAS. 1 / 11. Save image. Zoom image | View original size. Public Architecture Facade. Share Share this image. Facebook. Twitter.

SaltStick Caps

The wealthiest would make out the best, with a SALT cap repeal distributing more than $300,000 per household in the top 0.1 percent of earners and only $40 for a middle-income family over the.

Salt II Treaty

County Data Shows Repealing SALT Cap Would Benefit High-Income Earners. The $10,000 state and local tax (SALT) deduction cap has once again become a focal point in congressional tax policy discussions as House Republicans consider the proposed American Families and Jobs Act. Using 2020 data from the Internal Revenue Service (IRS), we can.

Incendi en el CAP de Salt TotSalt

The acronym SALT refers to the state and local tax deduction that taxpayers who itemize their federal returns are allowed to take. This deduction was unlimited until 2018 when it was capped at a.