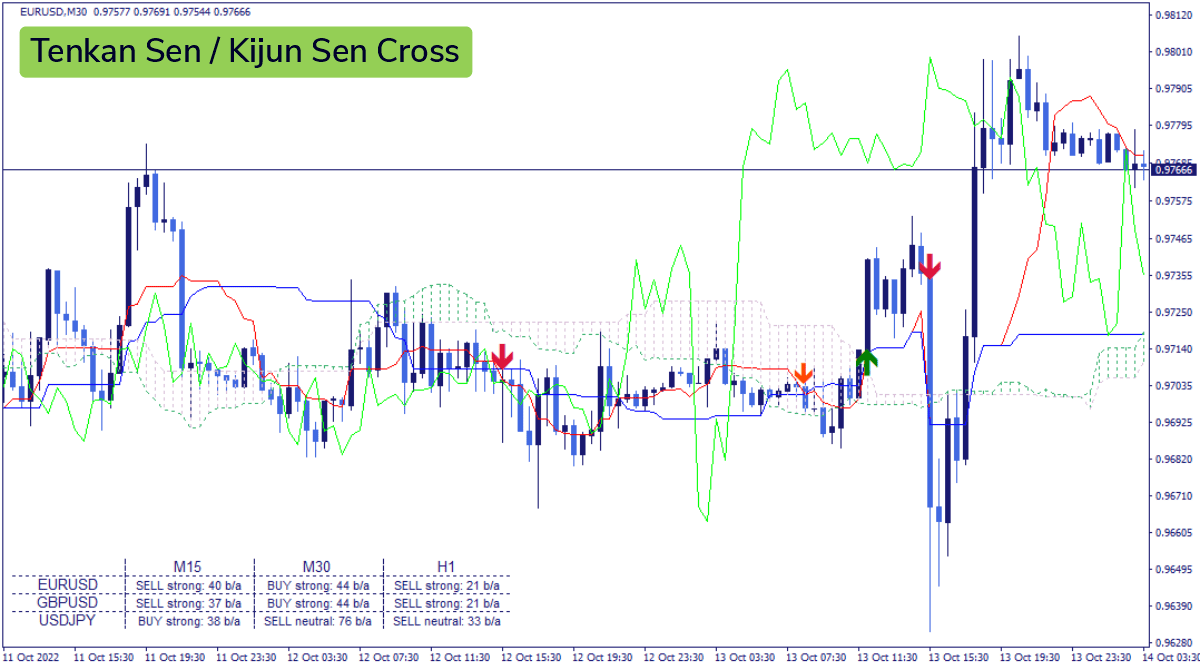

Ichimoku Buy/Sell Signals of manual MTF Tenkan crossing Kijun

The Kijun-sen is nearly always used alongside the Tenkan-sen (conversion line) to help gauge direction changes in price and to generate trade signals. Tenkan-sen is the 9-period price.

Kijun Tenkan Indicator for MT4 Download FREE IndicatorsPot

The Tenkan line represents the arithmetic mean of the highest High and the lowest Low over a specified time period (9 bars by default). The Kijun line is calculated similarly using the 26 bars period by default. The Chikou line represents the current Close price plot projected 26 bars back by default.

A beginner's guide to trading and investing Ichimoku Cloud (Kumo) charting

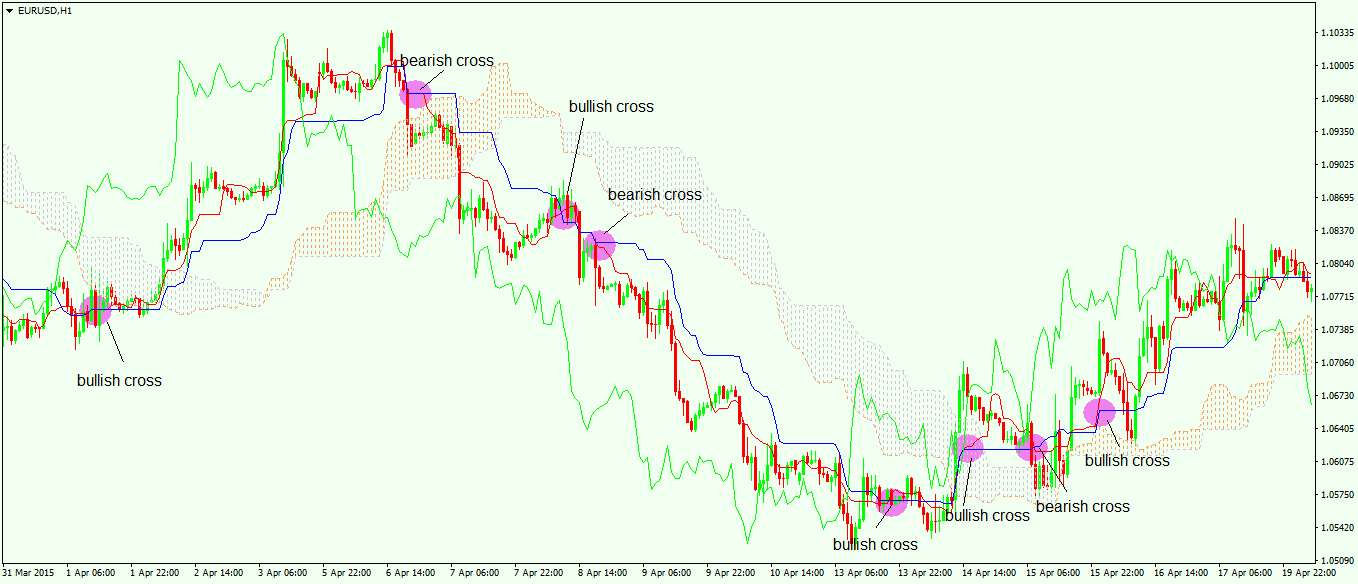

The Kijun/Tenkan cross is of extreme value to Forex traders, as it is highly visible and one cannot miss it. For this reason, attaching the Ichimoku indicator to a chart should ensure you are always on the alert for when the trend is going to change.

App Insights Easy Tenkan Kijun Cross Apptopia

The most common usage of the Tenkan and Kijun are the 'cross' or what we call the TKx ( Tenkan-Kijun Cross ). Similar to how a MACD uses a cross of its two lines, the Ichimoku Cloud does the same. It is interesting to note that the Ichimoku uses the same periods as the MACD, however it was created over a decade earlier.

ichimoku cloud binary options strategy Withrow Reld1995

# Ichimoku cloud scan input nTe = 9; # Tenkan length input nKi = 26; # Kijun length input nSp = 52; # SpanB length def Tenkan = (Highest (high, nTe) + Lowest (low, nTe)) / 2; def Kijun = (Highest (high, nKi) + Lowest (low, nKi)) / 2; def SpanA = (Tenkan [nKi] + Kijun [nKi]) / 2; def SpanB = (Highest (high [nKi], nSp) + Lowest (low [nKi], nSp)).

ICHIMOKU EXPLAINED PART 2 TENKAN SEN/KIJUN SEN CROSS for FXUSOIL by

The Tenkan and Kijun Sens lines are used as a moving average crossover signaling a change in trend and a trade entry point. The Ichimoku cloud represents current and historical price action.

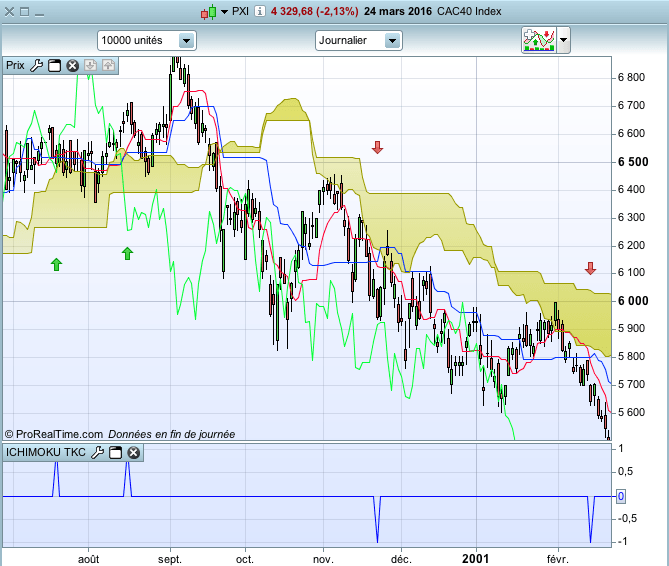

Ichimoku TenkanKijun Cross Indicators ProRealTime trading

Description The Ichimoku Cloud is a type of chart used in technical analysis to display support and resistance, momentum, and trend in one view. TenkanSen and KijunSen are similar to moving averages and analyzed in relationship to one another.

:max_bytes(150000):strip_icc()/Kijun-Sen-3b696ff097264a429b780a98afeb5cbe.png)

Kijun Line (Base Line) Definition and Tactics

The relationship between Tenkan-sen and Kijun-sen is one of the main aspects of Ichimoku Cloud. Tenkan-sen is an average that is based on fewer time periods than Kijun-sen's, thus responding to price changes faster. Therefore, traders should watch when Tenkan-sen moves above or below Kijun-sen as this is a signal for an uptrend or a downtrend.

KijunTenkan Cross & Forex Ultimate Guide & Explanation for FX Traders

Share 3.9K views 1 year ago SOMERSET In this video Eugenio explains what Tenkan Sen and Kijun Sen are and how these are used to determine momentum in the market and change in direction..

MT4 Ichimoku Indicator (Scanner)

The Kijun Line is typically used in conjunction with the Conversion Line (Tenkan-sen) to generate trade signals when they cross. These signals can be further filtered via the other components.

Kijun Tenkan Indicator • Best MT4 Indicators [MQ4 & EX4] • TopTrading

📈 Unlock the power of Ichimoku! In this insightful video, we delve into the significance of Tenkan and Kijun in the Ichimoku Kinko Hyo system, demystifying.

Tenkan Kijun Senkou Span Trading system

The Kijun-Sen is similar to the Tenkan-Sen but uses a more extended look-back period of 26 periods. It serves as a medium-term trend indicator and is often used as a support or resistance level. Senkou Span A (Leading Span A): (Tenkan-Sen + Kijun-Sen) / 2, plotted 26 periods ahead. Senkou Span A represents the average of the Tenkan-Sen and.

Trading the Tenkan Kijun Cross 2nd Skies Forex

Tenkan-Sen, or Conversion Line, is the mid-point of the highest and lowest prices of an asset over the last nine periods. The Tenkan-Sen is part of a larger indicator called the Ichimoku Kinko.

Ichimoku Cloud Trading Strategy Trading The Tenkan Kijun

The Tenkan-Kijun cross (also known as the TK cross) strategy is best traded on higher time frame charts, as the signals generated on these charts produce more pips. Furthermore, the trend is better represented on higher order charts such as the daily charts.

Tenkan sen Kijun sen cross for by tradingichimoku

The Tenkan Sen (conversion line) is calculated by the sum of the highest high and the lowest low divided by two. The default setting is 9 periods. The Kijun Sen (standard or base line) is based on the same formula as the Tenkan Sen, but the default here is 26 periods.

Apply Ichimoku Charting To Your Trading February 2013

An understanding of the Ichimoku calculations for the Tenkan-Sen and Kijun-Sen lines will help to apply the indicator more successfully in systematic trading.