How to create a VAT only invoice FreeAgent

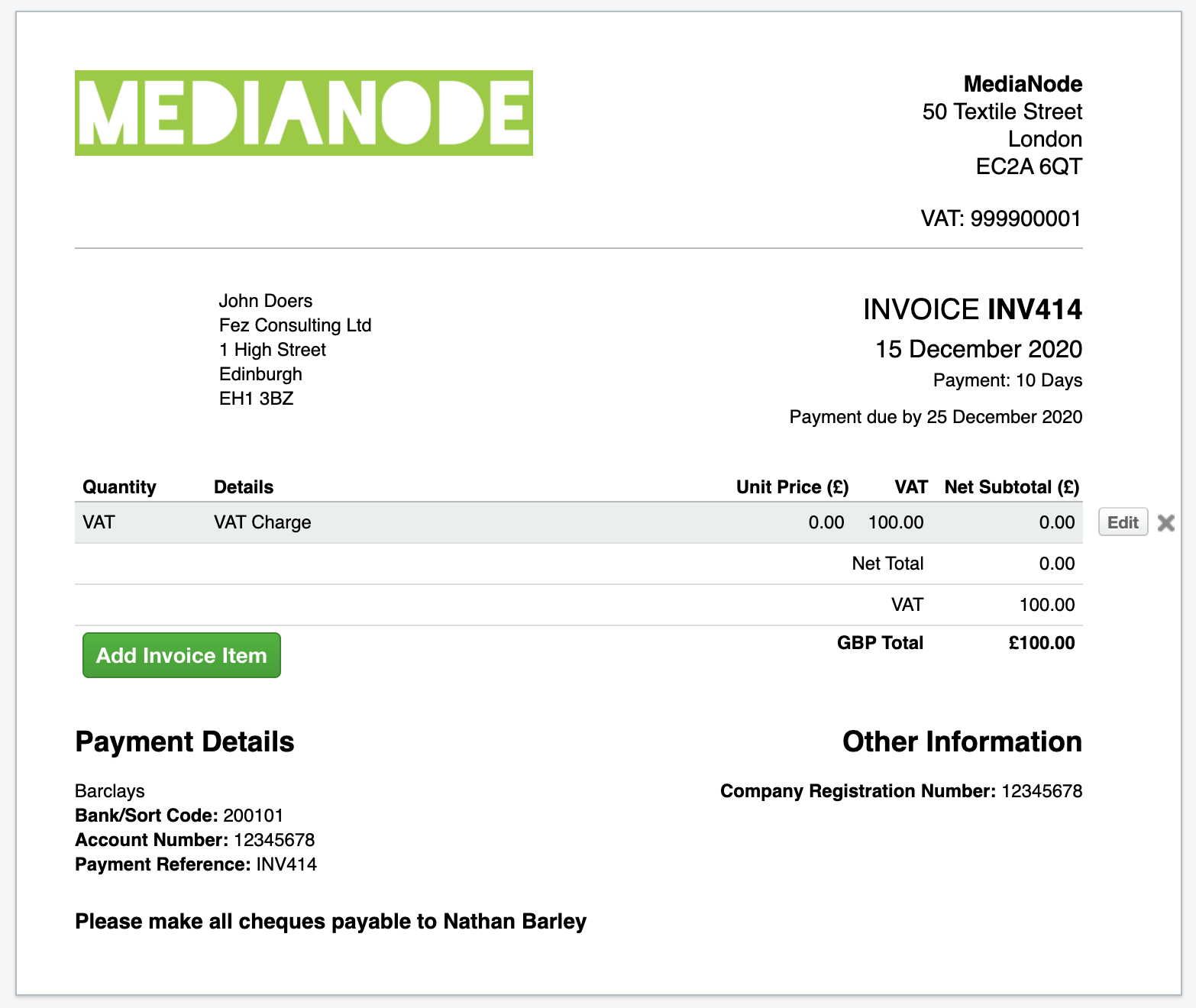

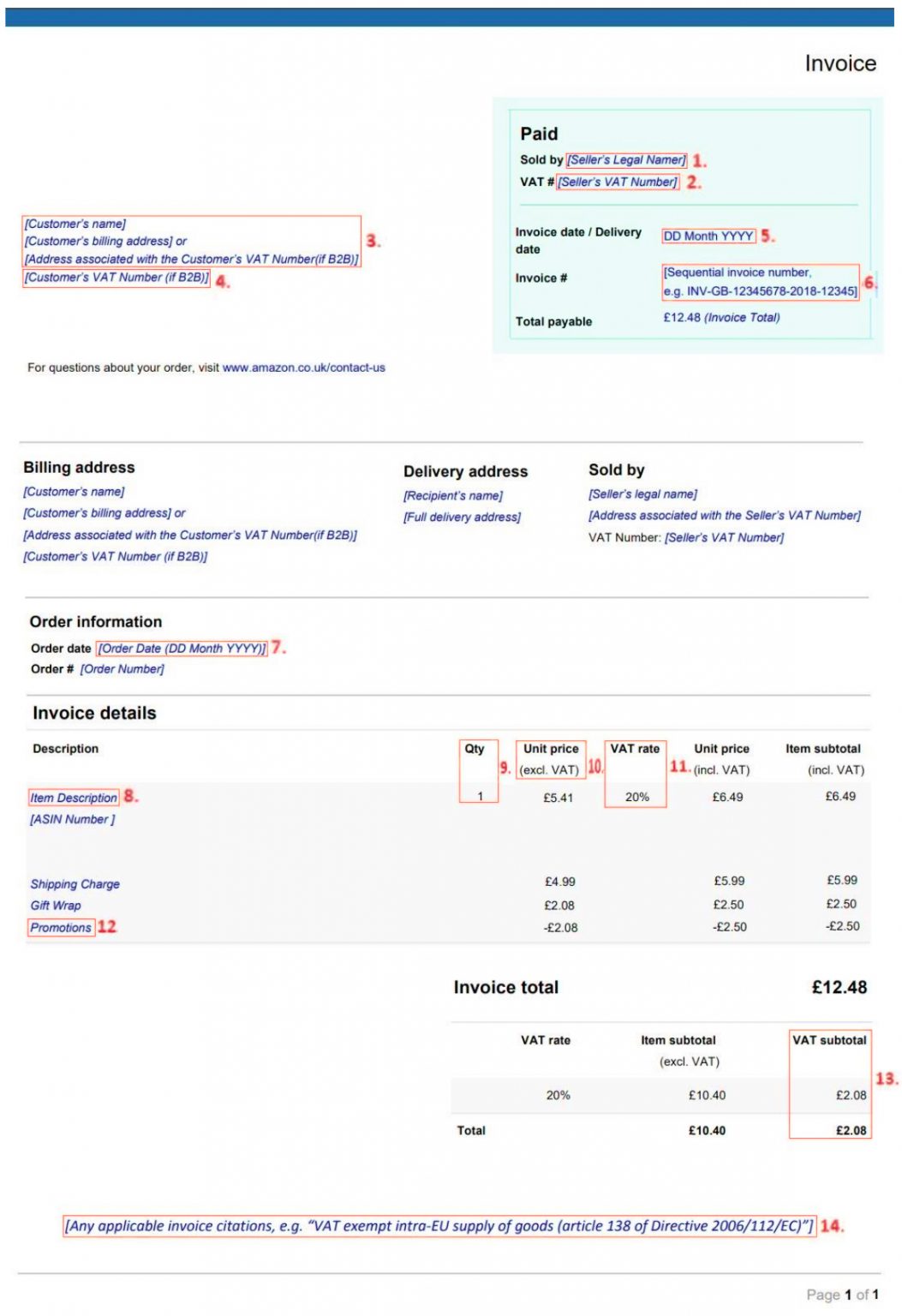

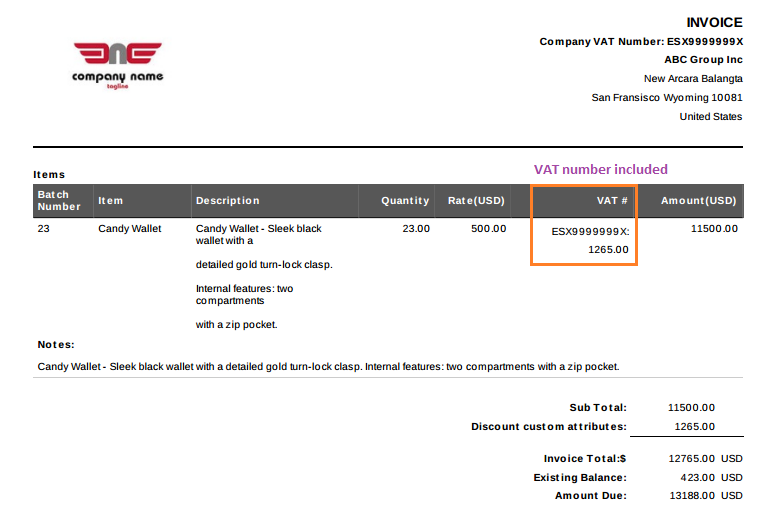

A VAT invoice is an invoice that a business issues to a client for goods and services subject to VAT. A properly documented VAT invoice includes all of the elements of a regular invoice, along with the VAT identification number and VAT amount charged per product.

Free VAT Invoice Template Free Download in PDF Bonsai

Example: VAT numbers for Germany start with the letters "DE" and are followed by 9 digits, such as DE123456789. Example: The VAT country code for Estonia is EE, so an Estonian business's VAT number may look like EE93810511 The letters at the start of a VAT number may change based on the language you're using.

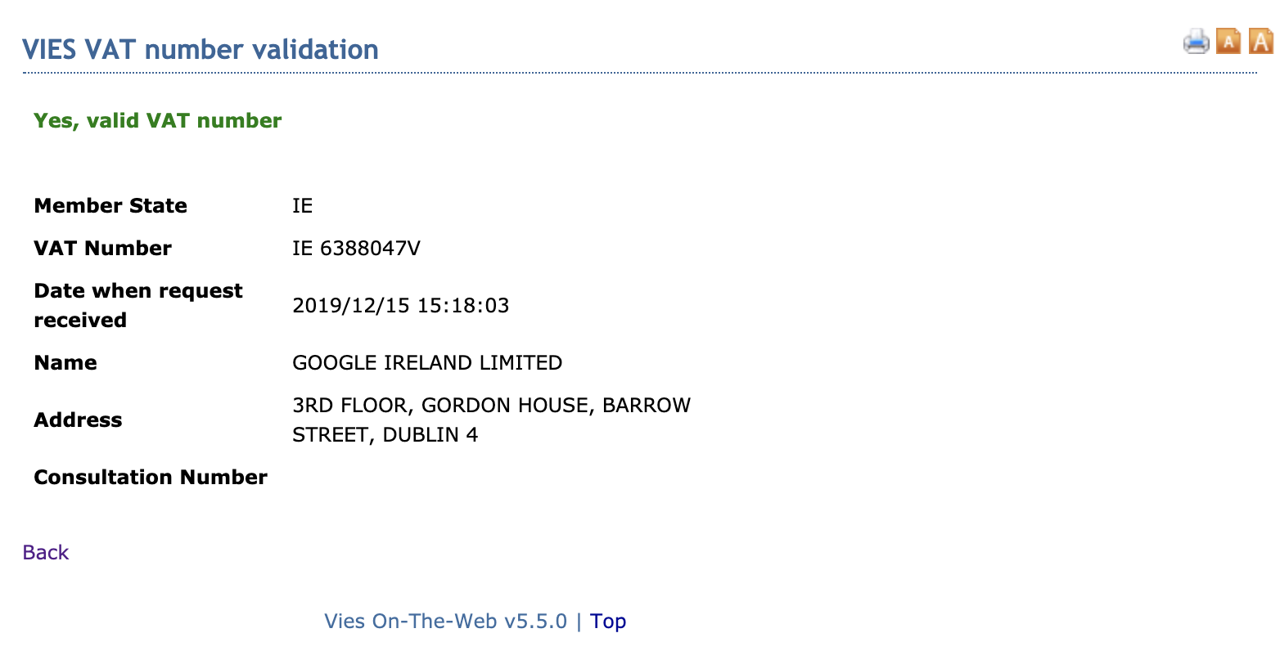

How to Check and Validate EU VAT Numbers Vatstack

VAT Number Formats. The VAT registration number is the unique number that identifies a taxable person (business) or non-taxable legal entity registered for VAT (Value Added Tax).. Vat n. example: Country code: Characters: VAT in local languages: Australia: 12345678901: AU: 11 characters: ABN (Australian business number) Austria: ATU12345678.

How VAT works and is collected (valueadded tax) WP Coupons

How many digits is a VAT number? This question is a classic example of how VAT numbers can be confusing and complex. However, it's easy to remember as long as you use the rule of three. (3) 3 digits, followed by a hyphen, followed by three more digits. Can a US company get a VAT number?

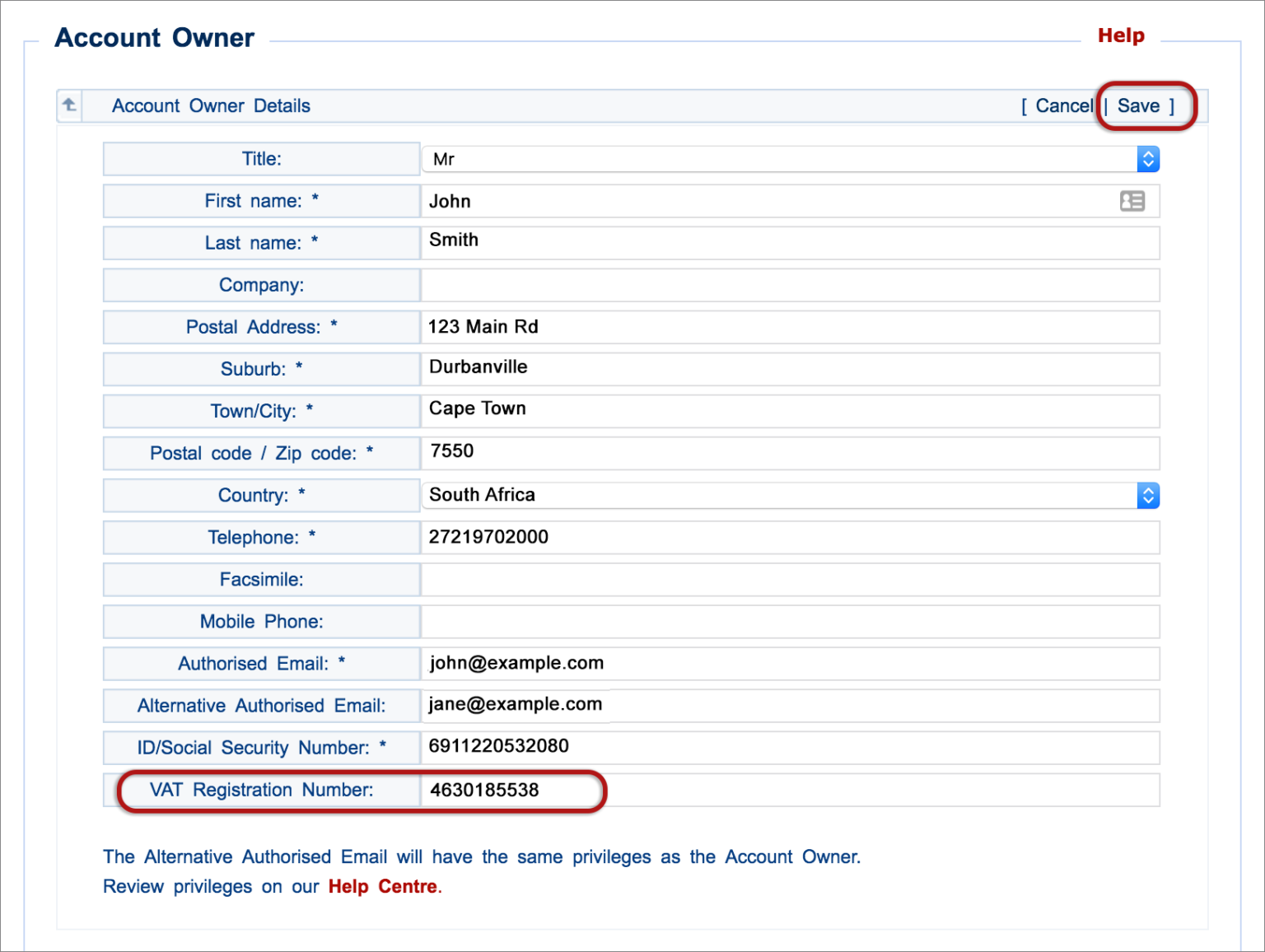

Update my VAT number xneelo Help Centre

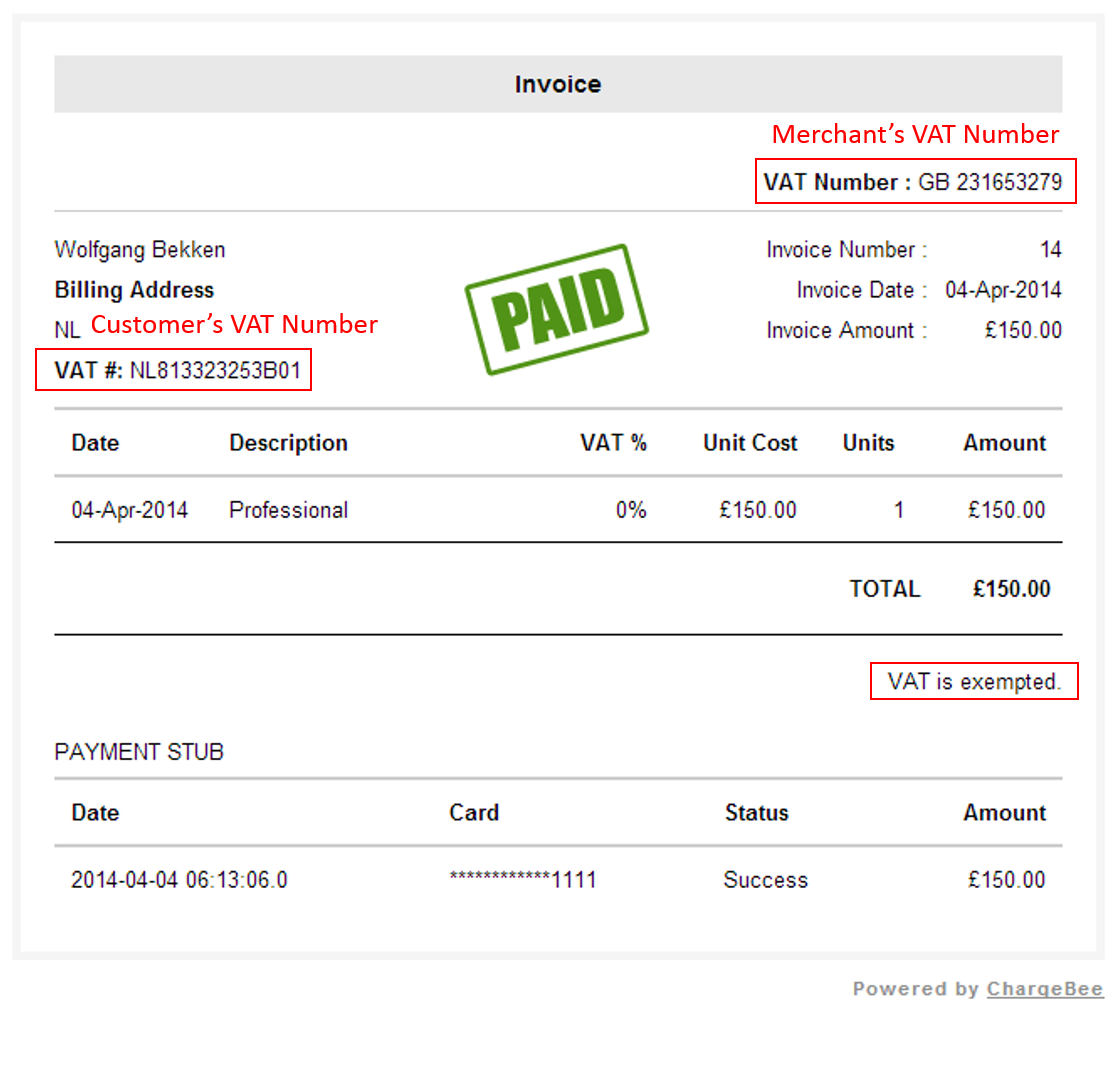

The VAT identification number is a series of numbers and letters that is different for every entrepreneur. A Dutch VAT number starts with NL, then comes 9 digits, the letter B, and then another 2 digits. Example: NL123456789B01. Your VAT number shows customers and suppliers that you are a VAT-registered entrepreneur.

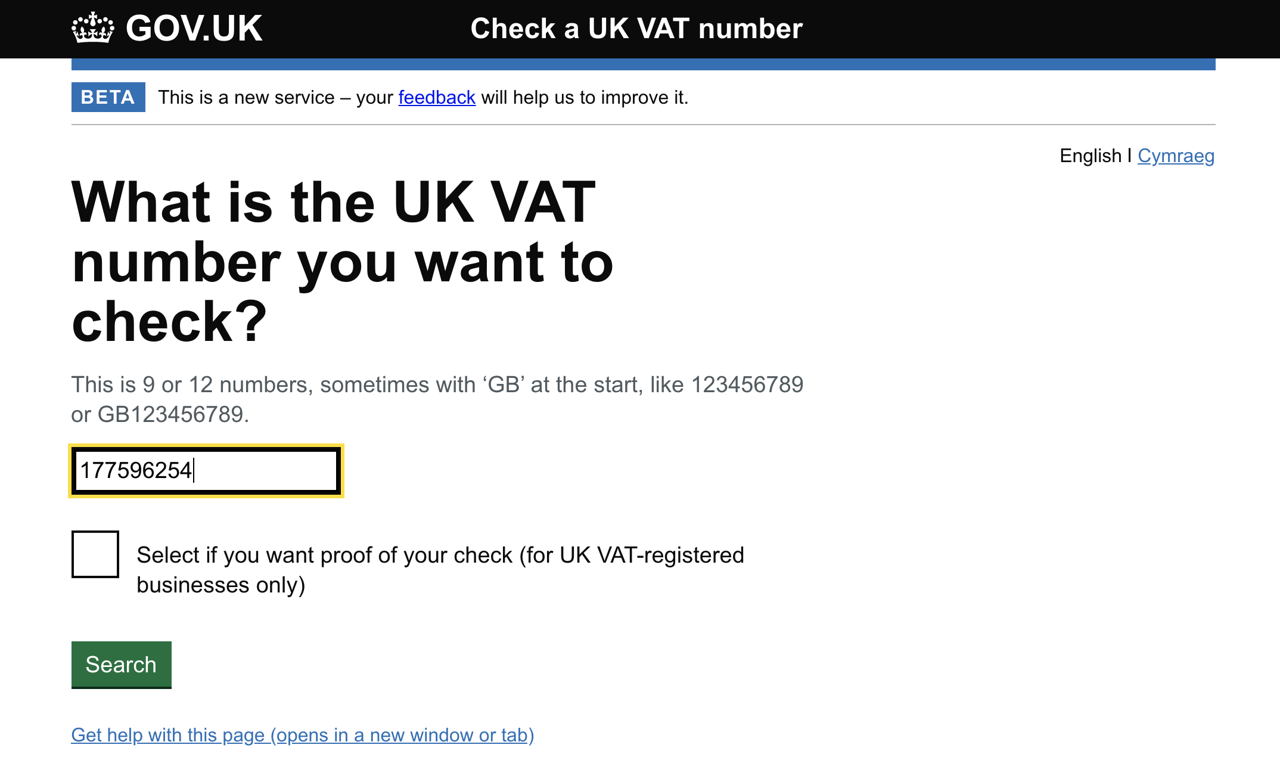

UK VAT Number Validation Vatstack

VAT number (also called VAT identification number, VAT registration number, VAT ID,. VAT number format, description and example, as well as its local name and abbreviation. Non-EU countries VAT number: List of non-EU countries that have similar rules regarding the VAT number, which are regulated by organizations such as EEA or EFTA.

VATnumber. What is that and how to get it? CloudOffice

As soon as your annual turnover of sales from one EU country (let's say France) to another one (e.g. Germany) exceeded this limit, you needed to register for VAT in the country of import (in this case Germany). The VAT threshold was set differently in each country, in Germany for example at 100,000 EUR.

VAT Return Get hands on help with your VAT Return

2022 - Learn about sales taxes within North America. Find out which goods or services are liable to sales tax when you should register and how to pay sales taxes.

VAT Number and VAT Registration Euro VAT Refund

VAT identification number A value-added tax identification number or VAT identification number ( VATIN [1]) is an identifier used in many countries, including the countries of the European Union, for value-added tax purposes. In the EU, a VAT identification number can be verified online at the EU's official VIES [2] website.

A ValueAdded Tax (VAT) Invoice GeekSeller Support

Also known as a Tax Identification Number (TIN), a Tax Number is a unique identifier issued to taxpayers engaging in taxable activities in a specific country. This number, which can be a combination of letters and numbers, serves as a signal that the taxpayer is officially registered with the relevant tax authority.

Include VAT Number In Invoices

Below is a summary of the standard formats for each EU country, plus: Norway; Switzerland; and UK. EU VAT number formats Click for free EU VAT number formats i nfo Each EU member country has a slightly different format for their VAT number system, featuring a variation of numbers and letters.

How does EU VAT work with ChargeBee? Chargebee Compass

Validation You're responsible for the accuracy of customer information including their tax ID number. The invoice includes the customer tax ID whether or not it's valid. Stripe provides automatic validation to help determine if the formatting is correct when you add the ID to our system.

How to Calculate VAT of UK in Tally 9 and its Accounting Treatment Accounting Education

A VAT number is a registered tax identification number in tax systems that use Value-Added Tax (VAT). When you register for VAT in a single country, you receive this identifier for their system.. For example, if you are registered in both France and Germany, you must use the French VAT number for sales to French customers, and the German.

What is the VAT Number? iContainers

VAT number 2023: Format, Registration, Threshold & more. E-commerce trade is becoming increasingly popular compared to traditional trade and brings one or two advantages with it. One would be, for example, the possibility of being able to trade across national borders. The prerequisite for intra-European trade is a VAT number, which identifies.

The Ultimate Guide to EU VAT for Digital Taxes

In principle, the VAT number consists of a prefix (country code at the beginning) and a suffix (numbers/letters for identification). When do you need a VAT Identification Number (VAT ID)? Typical cases in which a foreign entrepreneur must register for a local VAT number:

How VAT works and is collected (valueadded tax) Perfmatters

VAT Use these EU country codes, VAT numbers and foreign language letters to complete an EC Sales List (ESL).